NEW YORK, 2014-8-12 — /Travel PR News/ — In the second quarter (Q2) 2014, online channels – which include Online Travel Agents (OTAs), hotel websites (Brand.com) and global distribution systems (GDS) used by travel agents – continued to grow in popularity among individual business and leisure travelers, according to data from the TravelClick North American Distribution Review (NADR; Third Quarter 2014). The TravelClick NADR aggregates hotel bookings by channel for the transient segment (individual leisure and business travelers).

In Q2, 2014, the OTA channel (which includes Expedia, Priceline, Orbitz and Booking.com, etc.) experienced the largest jump in bookings, with a 12.8 percent increase in the second quarter compared to last year. Brand.com room night bookings increased year-over-year by 6.9 percent. The GDS channel grew 2.7 percent. Hotel Direct (calls directly to the property and walk-in customers) was flat at 0.3 percent from a year ago, and the CRS channel was slightly down, at -1.7 percent.

Average daily rates (ADR) across all transient channels grew 3.7 percent in Q2, 2014 compared to the second quarter 2013. The OTA channel had the highest ADR growth with an increase of 10.7 percent. Additional channels that showed growth include: Hotel Direct, up 2.7% percent; GDS up 4.0 percent; CRO up by 2.1 percent and Brand.com up 3.9 percent.

In Q3, 2014, OTA ADR is tracking ahead by 11.3 percent, based on reservations currently on the books. ADR for the third quarter is also growing for the other channels, up 4.7 percent for the GDS channel, 2.7 percent for the hotel direct channel, 3.8 percent for Brand.com and 2.0 percent for the CRO channel.

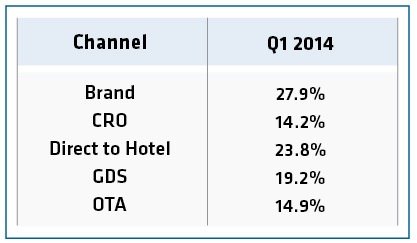

Share of Transient Rooms Sold by Channel

The table illustrates the share of transient room nights by channel based on actual reservations.

“Consumers are increasingly turning to online channels – whether it’s a hotel’s website or an OTA – to book their hotel stays. TravelClick’s NADR data continues to show the scope and magnitude that all channels have in generating increased bookings and revenue,” said John Hach, Senior Vice President, Global Product Management of TravelClick. “This is an opportune time to be a hotelier, as hotels increased revenue per available room (RevPAR) by 6.8% for Q2 2014, compared to just a year ago.”

TravelClick_August NADR_2014.pdf

# # #

About TravelClick, Inc.

TravelClick (TravelClick.com) provides innovative cloud-based solutions for hotels around the globe to grow their revenue reduce costs and improve performance. TravelClick offers hotels world-class reservation solutions, business intelligence products and comprehensive media and marketing solutions to help hotels grow their business. With local experts around the globe, we help more than 38,000 hotel clients in over 160 countries drive profitable room reservations through better revenue management decisions, proven reservation technology and innovative marketing. Since 1999, TravelClick has helped hotels leverage the web to effectively navigate the complex global distribution landscape. TravelClick has offices in New York, Atlanta, Philadelphia, Chicago, Barcelona, Dubai, Hong Kong, Houston, Melbourne, Orlando, Shanghai, Singapore and Tokyo. Follow us on twitter.com/TravelClick and facebook.com/TravelClick.

Danielle DeVoren/ Anna Susman

KCSA Strategic Communications

212.896.1272 / 212.896.1253

ddevoren@kcsa.com / asusman@kcsa.com