NEW YORK, 2014-2-13 — /travelprnews.com/ — In the fourth quarter (Q4) 2013, online channels which include Online Travel Agents (OTAs), hotel websites (Brand.com) and global distribution systems (GDS) used by travel agents continued to experience year-over-year growth in hotel room nights booked, according to data from the TravelClick North American Distribution Review (NADR; First Quarter 2014). The same trend is expected to continue in Q1 2014. The NADR aggregates hotel bookings by channel for the transient segment (individual leisure and business travelers).

The OTA channel experienced the largest jump in room nights, with an 18.2 percent increase in the fourth quarter compared to last year. Brand.com room nights increased year-over-year by 9.1 percent. GDS room nights grew 5.3 percent. Hotel Direct (calls directly to the property and walk-in customers) and calls to a hotel’s 800-number, the CRO channel, decreased -3.5 and -3.1 percent respectively.

Average daily rates (ADR) across all channels in Q4 grew 2.4 percent compared to last year. The OTA channel had the highest ADR growth with an increase of 8.0 percent. Additional channels that showed growth include: Hotel Direct, up 1.8 percent; GDS up 2.6 percent; CRO up by 0.8 percent and Brand.com up 1.5 percent.

In Q1, OTA ADR is tracking ahead by 8.6 percent, based on reservations currently on the books. ADR for the first quarter is also growing for the other channels, up 2.8 percent for the CRO channel, 5.7 percent for the hotel direct channel, 4.9 percent for the GDS channel, and 2.9 percent for Brand.com.

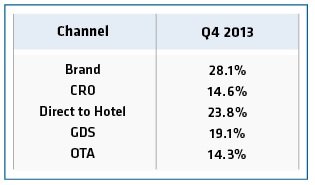

The table illustrates the share of transient room nights by channel based on actual reservations.

“Leisure travelers continue to use the myriad of booking channels at their disposal to make hotel reservations,” said Tim Hart, executive vice president, business intelligence, TravelClick. “However, as we have seen for the past several years, more and more are turning to online channels– whether it’s a hotel’s website or an OTA – to book their stays. While OTAs continue to grow their share of leisure bookings in particular, every channel is significant and plays an important role. This reinforces the need for hotels to optimize reservations strategies across all channels to ultimately increase revenue per available room (RevPAR).”

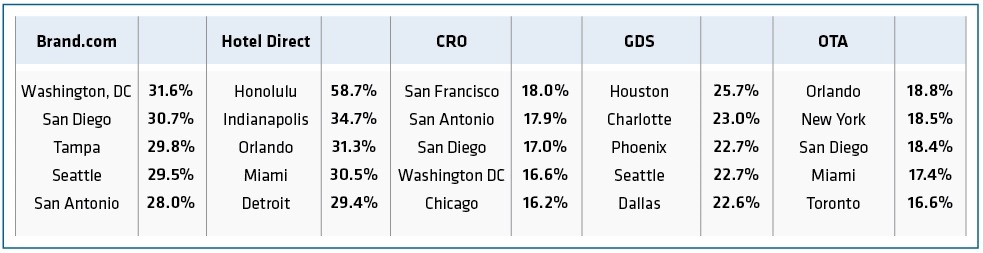

The chart illustrates the cities that receive the most share of bookings broken out by channel.

About TravelClick, Inc.

TravelClick (TravelClick.com) provides innovative cloud-based solutions for hotels around the globe to grow their revenue reduce costs and improve performance. TravelClick offers hotels world-class reservation solutions, business intelligence products and comprehensive media and marketing solutions to help hotels grow their business. With local experts around the globe, we help more than 36,000 hotel clients in over 160 countries drive profitable room reservations through better revenue management decisions, proven reservation technology and innovative marketing. Since 1999, TravelClick has helped hotels leverage the web to effectively navigate the complex global distribution landscape. TravelClick has offices in New York, Atlanta, Philadelphia, Chicago, Barcelona, Dubai, Hong Kong, Houston, Melbourne, Orlando, Shanghai, Singapore and Tokyo. Follow us on twitter.com/TravelClick and facebook.com/TravelClick.

Danielle DeVoren/ Taylor McGrann

KCSA Strategic Communications

212.896.1272 / 212.896.1253

ddevoren@kcsa.com / tmcgrann@kcsa.com