Final GBTA BTI™ Outlook of the Year Shows Rising Momentum, But GBTA Sees Serious Concerns from Business Travel Professionals

Alexandria, VA, 2013-10-16 — /travelprnews.com/ — Business travel spending is expected to see a robust year in 2014 fueled by steady corporate profits, increases in business investment and an improving U.S. economy. However, the ongoing government shutdown and potential default could derail progress and is already impacting business travel sentiment.

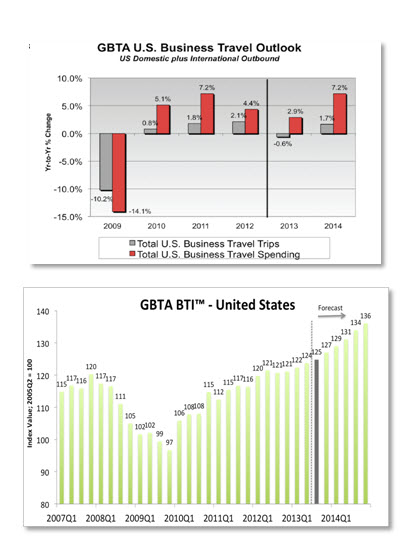

The final GBTA BTI™ Outlook – United States of the year, sponsored by Visa, Inc., forecasts that total U.S. business travel spending should grow by 7.2% in 2014, reaching $288.8 billion. Reversing a 2013 decline in trip volume, total trips taken should grow by 1.6% to 459.2 million. But a GBTA survey of more than 250 business travel professionals released Friday finds that two-thirds of respondents (66%) are concerned that their business will be negatively impacted by a shutdown longer than one week. A potential U.S. government default is a serious concern for 59%of respondents.

“The business travel industry is a key driver of the U.S. economy, and business travel is looking at a strong rebound year in 2014. The current government shutdown and potential default couldn’t have come at a worse time. Just as we’re finally turning a corner, all of these gains are being put at risk,” said Michael W. McCormick, GBTA executive director and COO. “We strongly urge Congress to recognize the damage caused by these unnecessary disruptions to U.S. business travel and keep our country open for business.”

“Business travel spend is also a leading indicator of employment growth by one to two quarters. Clearly, the GBTA outlook for 2014 should bode well for the job market, but it all depends on whether our elected leaders can keep the economy on track,” McCormick added.

To date, 40% of respondents say the shutdown has already impacted them, their company and or their company’s employees. Of those who reported feeling an effect, the top three impacts were:

- Cancelled meeting or business opportunities in the United States – 57%

- Increased uncertainty about the economy – 57%

- Cancelled bookings – 50%

Specific examples of the shutdown’s impact on business travel professionals are included below.

2014 Outlook is Positive – For Now

GBTA currently expects that 2014 spending will be strong across all categories of business travel:

- International outbound spending should increase by 12.4% to $36.6 billion on a 7.2% increase in trips.

- Group travel spending should increase by 7.2% to $124.1 billion on a 1.5% increase in trips.

“If we can keep our economy on track, we should see robust international outbound growth, and emerging markets in regions like Latin America, Asia and the Middle East should see a growing percentage of U.S. traffic. The outlook for meetings is also a positive sign, because these are longer-lead spending decisions that businesses only make if they’re feeling more confident about the direction of the economy and their own growth prospects,” McCormick added.

In 2014, both international outbound travel and the meetings and events sector are forecast to turn in their strongest growth since 2011, as shown in the following chart:

(all figures in billions)

| 2011 | 2012 | 2013 | 2014 | |

| International Outbound Spending | $31.8 | $32.1 | $32.6 | $36.6 |

| International Outbound Percentage Growth | 9.2% | 0.8% | 1.5% | 12.4% |

| Group Spending | $107.7 | $111.3 | $115.7 | $124.1 |

| Group Spending Percentage Growth | 7.2% | 3.3% | 4.0% | 7.2% |

“As the world’s largest business travel market, the forecasted growth in the U.S. market in 2014 is good news for business travel industry buyers and suppliers,” said Tad Fordyce, head of global commercial solutions at Visa, Inc.

GBTA BTI: Picking Up Momentum

The GBTA BTI™ is a proprietary index of business travel activity. Growth in the index picked up over the first two quarters of 2013 and should continue to gain momentum over the forecast horizon. The index is expected to continue rising, reaching 127 by the end of 2013.

While some of the gains in 2013 can be attributed to price growth in hotel costs and airfares, GBTA expects real travel spending growth to be stronger in 2014, represented by an increase in the BTI to 136 by year-end 2014.

Examples of Shutdown Impact

The chart below shows examples of the impact of the shutdown provided by survey respondents:

| Impact | Example |

| Lost Employees | “Our company has forced support/administrative employees to take leave until other direct client facing employees return to work.” “Some of our employees are government contractors who were issued a stop work order. They may not be paid when they get back.” |

| Cancelled Bookings | “Loss of room night revenue due to cancelled meetings…and loss of room night revenue due to famed attractions being closed.” |

| Cancelled Meetings | “We do installation for government suppliers and those meetings are cancelled because government orders are stopped for the time being.” |

| Delays in Passports and Visas | “Concern it may have impact on ability to get rush visas, passports for our international travelers.” |

Key Metrics

The GBTA BTI™ Outlook – United States report is available exclusively to GBTA members by clicking here and non-members may purchase the report through the GBTA Foundation by emailing pyachnes@gbtafoundation.org.

CONTACT:

Colleen Lerro, +1 703 236 1133, clerro@gbta.org

Rebecca Carriero, +1 212 446 1897, rcarriero@sloanepr.com

About the GBTA BTI™ Outlook – United States

The GBTA BTI™ Outlook – United States projects aggregate business travel trends over the next eight quarters. The report includes key buy-side metrics such as total business travel volume and spending, plus supply-side projections of changes in costs, across both transient and meetings travel. Releases are published on the second Tuesday of each quarter.

The GBTA BTI™ Outlook uses an econometric model to better inform the forecast process. The model explicitly relates measures of business trip volume and spending, sourced from D.K. Shifflet & Associates to key economic and market drivers of business travel including: U.S. Gross Domestic Product (GDP) and its components, U.S. Corporate Profits and Cash Flow, U.S. Employment & Unemployment, ISM Business Sentiment Index, Key Travel Components of CPI (airfare, lodging, food away from home, rental cars, fuel, transportation), among other components.

The GBTA Foundation is the education and research foundation of the Global Business Travel Association (GBTA), the world’s premier business travel and corporate meetings organization.