Business Travel Index Reaches Pre-Recession High

Stock Market Strength Should Translate to Increased Business Travel Spending

Alexandria, VA, 2013-04-09 — /travelprnews.com/ — An improving economic outlook with business and consumer confidence on the rise is expected to boost business travel in 2013, leading the Global Business Travel Association to upgrade its forecast for the year. Stronger corporate profits, increasing job development and improvements in key export markets are fueling business travel spending after a sluggish fourth quarter that was dampened by political uncertainty due to the “fiscal cliff” debate.

According to the GBTA BTI™ Outlook – United States 2013 Q1, a report from the Global Business Travel Association sponsored by Visa, Inc., U.S. business travel is now expected to rise 5.1% in 2013 to $268.5 billion, which is an upgrade from the 4.6% growth to $266.7 billion that GBTA predicted last quarter and a substantial increase from 1.8% growth in 2012.

- GBTA’s forecast upgrade will be driven in part by stronger growth in group spending, which is now expected to increase 6.0% to $115.9 billion – up from 5.2% growth forecast in Q4.

- GBTA’s outlook for trip volume remains essentially the same from last quarter – a slight decline of -1.1% to 431.7 million person-trips.

“Business confidence is up and the need to compete in the global economy is driving companies to invest in business travel,” said Michael W. McCormick, GBTA executive director and COO. “Despite continued political uncertainty in the U.S. and around the world, businesses are beginning to break out of their holding pattern and seek growth more aggressively. While there are still many factors that could hamper the economy again, from the impact of sequestration to rising energy prices, business travel spending is heading in the right direction so far in 2013.”

“As corporate and consumer spending confidence rises, the business travel forecast in the United States is starting to brighten,” said Tad Fordyce, head of global commercial solutions at Visa Inc. “While the report shows the trip volume among business travelers will remain steady, we remain optimistic that stronger spending will help 2013 business travel exceed its pre-recession high.”

GBTA BTI to Surpass Pre-Recession High

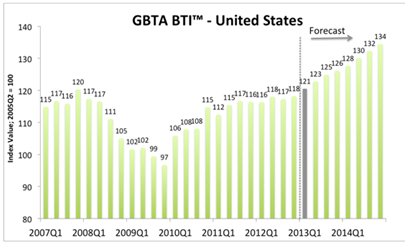

The GBTA BTI™, a proprietary index of business travel activity, is now estimated to reach 121 in Q1 2013. This means the BTI would finally exceed its pre-recession high of 120 and mark a comeback from its low of 97 in Q4 2009.

The BTI is expected to continue rising for the rest of 2013, reaching 126 by the end of the year.

Stock Performance Bodes Well

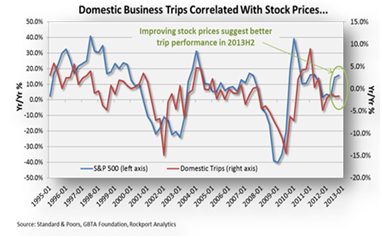

The report uncovered a strong correlation between stock prices and business travel spending, revealing that stock prices historically lead trip volume by 1-2 quarters (as shown in the chart below). With the market hitting record highs in Q1, business travel should be poised to pick up additional momentum throughout the second half of 2013. This is a good sign, indicating what GBTA believes will be an improving environment for business spending and hiring.

Notably, job development is now on the rise in industries that tend to require more business travel such as business services, finance, and utilities. This is a marked shift from late last year when job creation favored less travel-prone sectors like retail and restaurants.

KEY METRICS

The GBTA BTI™ Outlook – United States 2013 Q1 report is available exclusively to GBTA members by clicking here and non-members may purchase the report through the GBTA Foundation by emailing pyachnes@gbtafoundation.org. To view an abstract of this research, click here.

About the GBTA BTI™ Outlook – United States

The GBTA BTI™ Outlook – United States projects aggregate business travel trends over the next eight quarters. The report includes key buy-side metrics such as total business travel volume and spending, plus supply-side projections of changes in costs, across both transient and meetings travel. GBTA BTI™ Outlook – United States 2013 Q1 is the eleventh report in the series. Releases are published on the second Tuesday of each quarter.

The GBTA BTI™ Outlook uses an econometric model to better inform the forecast process. The model explicitly relates measures of business trip volume and spending, sourced from D.K. Shifflet & Associates to key economic and market drivers of business travel including: U.S. Gross Domestic Product (GDP) and its components, U.S. Corporate Profits and Cash Flow, U.S. Employment & Unemployment, ISM Business Sentiment Index, Key Travel Components of CPI (airfare, lodging, food away from home, rental cars, fuel, transportation), among other components.

CONTACT: Meghan Henning, 703-236-1133, mhenning@gbta.org

Rebecca Carriero, 212-446-1897, rcarriero@sloanepr.com

About the GBTA Foundation

The GBTA Foundation is the education and research foundation of the Global Business Travel Association (GBTA), the world’s premier business travel and corporate meetings organization.

Collectively, GBTA’s 5,000-plus members manage over $340 billion of global business travel and meetings expenditures annually. GBTA provides its network of 21,000 business and government travel and meetings managers, as well as travel service providers, with networking events, news, education & professional development, research, and advocacy. The foundation was established in 1997 to support GBTA’s members and the industry as a whole. As the leading education and research foundation in the business travel industry, the GBTA Foundation seeks to fund initiatives to advance the business travel profession. The GBTA Foundation is a 501(c)(3) nonprofit organization. For more information, see gbta.org and gbta.org/foundation.