Chinese Authorities Rebalance Economy Towards Domestic Growth to

Counteract Impact of Euro crisis

Beijing – 2012-10-18 — /travelprnews.com/ — GBTA announces the results of its second GBTA BTI™ Outlook – China report, a semi-annual analysis of one of the largest business travel markets in the world. The report, sponsored by Visa, includes the GBTA BTI™, an index of business travel spending that distills market performance over a period of time.

Highlights

- China’s economy has slowed in lockstep with Europe’s woes. GBTA forecasts that China’s GDP will grow by only 7.8% in 2012, down from 9.2% GDP growth in 2011

- Chinese authorities have managed their economy through the global slowdown, with the economy being purposely rebalanced toward domestic growth

- Chinese business travel will continue to show strong growth over the next 18 months, with total business travel spending forecast to grow by 12.5% in 2012 to $195 billion, followed by another14.7% in 2013

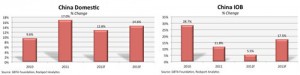

- Domestic business travel will recover sooner and more strongly than international outbound (IOB). In 2012 domestic travel spend will grow by 12.8%. It is expected that in 2013 domestic spend will grow 14.6% reaching $213 billion USD

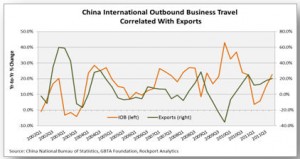

- Growth in IOB is forecast to slow considerably over 2012 reaching only 5.5% growth, compared to 12% growth in 2011. In 2013, IOB is expected to grow 17.5% reaching $10 billion USD

Welf J. Ebeling, regional director, GBTA Asia remarked: “The slowdown in economic growth, attributable to the worsening situation in Europe, has been of concern to the Chinese population. The good news, however, is that the Chinese government is responding. Fiscal intervention in 2012 and 2013, as well as stronger domestic demand, should help domestic travel spending rise by over 12% in 2012. Looking ahead, we are also confident that this will translate to higher growth in overall business travel spend in 2013.”

Economic stimulus and domestic business travel

China has found that in spite of its strong growth levels it has not been isolated from the current global slowdown. This has been reflected by lower than expected GDP growth in 2012, and consequently a revised forecast for lower business travel spend. To address these setbacks the Chinese government has purposely rebalanced the economy towards domestic growth over the past few years. This has been done through the introduction of fiscal stimulus, with an increase in infrastructure spending, which includes the Ministry of Railway increasing investment projects by 16%, for example.

Domestic business travel has disproportionately benefited from these policies and in 2012 GBTA expects growth of 12.8% for domestic business travel. This level of growth is not reflected in IOB travel, for which the GBTA has forecast 5% growth this year. This slowdown in growth can be attributed in part to a significantly lower level of demand for Chinese exports, particularly in the U.S. and Europe. (Exports represent nearly 30% of Chinese GDP.)

Continued growth in business travel spend

The outlook for China is still very positive despite the slight reduction in the expected rate of GDP growth. GBTA forecasts that 2013 will see an improvement in total business travel spend, with growth of 14.7% in 2013. As China’s main export partners recover it is forecast that IOB will resume its fast-paced growth, with GBTA forecasting growth of 17.5%. Domestic business travel is also set to increase with growth of 14.6%.

Overall, Chinese business travel spending is one of the highest in the world, second only to the USA. There is, however, room for more growth. China still faces considerable supply side constraints to business travel, with the second and third tier markets affected the most. Action is being taken to address this issue and over the past ten years the size of the four largest airports has doubled and hotel room supply has risen in the major business centers. GBTA believes that at the current prevailing growth rates, and with the increased investment in infrastructure, China will pass the USA by 2014 to become the country with highest level of business travel spend, one year earlier than previously forecast. This is reflected by the GBTA BTI™, which forecasts an expansion of 83 points in 2013, reaching a new high.

For further information please contact:

Pelham Bell Pottinger

Katie Bergius/ Harriet Blackburn +44 20 7861 3105

About the GBTA BTI™ Outlook – China

The GBTA BTI™ Outlook projects aggregate business travel trends over the next eight quarters. The report tracks business travel spending in total and by domestic and outbound segments. It relates unfolding economic events at home and abroad to their resulting impacts on China’s business travel market. GBTA BTI ™ – China 2012 is the second report in the semi-annual series. Releases are planned for April and October.

The GBTA BTI™ Outlook uses an econometric model to better inform the forecast process. The model explicitly relates measures of business travel spending, uniquely sourced from other GBTA Foundation research, to key economic and market drivers of business travel including: Gross Domestic Product (GDP) and its components; employment and unemployment; measures of business and consumer confidence; international trade, foreign direct investment and exchange rates; commodity and oil prices; inflation measures; productivity rates for business travel; International Air Transport Association (IATA) Passenger and Revenue Performance and Smith Travel Research (STR) Global Hotel Performance.

The GBTA BTI™ Outlook – China is free of charge to all GBTA Members by clicking here. Non-members may purchase the report through the GBTA Foundation by emailing pyachnes@gbtafoundation.org.

About the GBTA Foundation

The GBTA Foundation is the education and research foundation of the Global Business Travel Association (GBTA), the world’s premier business travel and corporate meetings organization.

Collectively, GBTA’s 5,000-plus members manage over $340 billion of global business travel and meetings expenditures annually. GBTA provides its network of 21,000 business and government travel and meetings managers, as well as travel service providers, with networking events, news, education & professional development, research, and advocacy. The foundation was established in 1997 to support GBTA’s members and the industry as a whole. As the leading education and research foundation in the business travel industry, the GBTA Foundation seeks to fund initiatives to advance the business travel profession. The GBTA Foundation is a 501(c)(3) nonprofit organization. For more information, see gbta.org and gbta.org/foundation.

###