GBTA Forecast Anticipates Nearly 7% Year-Over-Year Rise in Spending, Indicating Confidence in U.S. Economic Recovery

Alexandria, VA, 2014-7-10 — /Travel PR News/ — A leading travel industry forecast finds U.S.-originated business travel grew nearly 3% year-over-year, with company spending for business travelers increasing 7.6% to $71.2 billion during 2014 Q1 / the first quarter of 2014. This indicates rising management confidence in the economic recovery, which tends to accompany increased travel budgets and fewer travel restrictions. Overall, U.S.-generated business travel spending is expected to increase 6.8% to $292.3 billion in 2014.

The Global Business Travel Association (GBTA) –the voice of the global business travel industry – reaffirmed its positive forecast of the U.S. business travel industry with the release of the GBTA BTI™ Outlook – United States 2014 Q2, sponsored by Visa, Inc. The report highlights the important relationship of business travel to overall U.S. economic growth.

“Business travel spending in the U.S. supports 7.1 million jobs,” said Michael W. McCormick, GBTA executive director and COO. “We continue to see a correlation: growth in business travel is intrinsically linked to jobs development and ultimately growth in the U.S. economy.”

The report’s other key findings include:

– The total number of domestic person business trips in 2013 was revised upward to 468.8 million from the previously reported 448.7 million, resulting in a 4.7% year-to-year gain. Spending remained consistent with the previous forecast at $241 billion, indicating a lower-than-estimated spend per trip.

– Group business travel significantly outperformed individual business travel in 2013, growing 8.6%, a significant indicator that the business travel industry is recovering from the Great Recession and increasing discretionary spending.

– While individual business travel volume is only expected to grow 2.3% in 2014, spending is expected to increase 5.6%, driven by higher prices and additional spend-per-trip.

“Electronic payments play an integral role in the U.S. business landscape, allowing Visa to help companies and business travelers understand and react to the ever-changing business travel market,” said Tad Fordyce, SVP and head of Global Commercial Solutions, Visa Inc. “The expected growth outlined in the GBTA BTI™ means for exciting times not only in the business travel market but for our country’s economy as well, and will allow Visa along with GBTA, to continue to create best-in-class solutions for our financial institution customers and their clients.”

In addition, the study identified other key trends that could impact business travel in the coming months, including the price of oil, cost of travel and international outbound business travel.

Volatile Oil Prices and U.S. Business Travel – No Immediate Impact

Oil prices have a direct impact on business travel, causing the price of jet fuel and other travel related expenses to fluctuate. Oil prices also provide future insight into both economic growth and travel inflation. Currently, oil supply is tracking well above demand, suggesting favorable oil prices on the horizon. Geopolitical upheaval – particularly in the Middle East – is always a risk, causing oil spikes and almost immediate downstream increases in airfare and other travel prices.

Travel Prices Expected to Remain Relatively Low Through 2014

GBTA expects travel price growth to remain relatively low at 1.9%, before picking up pace in 2015. The low estimate is in large part due to the relatively stable airfare prices, but prices are likely to rise as consolidation in the industry puts more pricing power in the hands of the airlines. Rising food prices, rental car rates and lodging are currently the largest contributors to travel price growth.

International Outbound Business Travel Continues Increasing

International outbound business travel continues to rise, with trip volume expected to grow 6.6% and trip spending increasing 10.3% in 2014. This data indicates that the global economic recovery is underway. Although things appear to be on the upswing, GBTA continues to be cautious. Lower-than-expected inflation poses risks for advanced economies, there is increased financial volatility in emerging market economies and increases in the cost of capital will likely dampen investment and weigh on growth.

GBTA BTI™ Progresses Upward

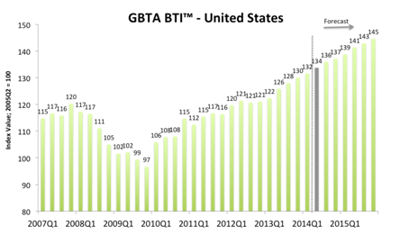

The GBTA BTI™, a proprietary index of business travel activity, is now estimated to reach 134 in Q2 2014, bolstered by a strengthening domestic economy, an improving external environment and slightly higher travel prices. This represents a two-point gain over the previous quarter and an eight-point year-to-year gain.

The BTI is expected to continue rising for the rest of 2014, reaching 137 by the end of the year.

Key Metrics:

The GBTA BTI™ Outlook – United States report is available exclusively to GBTA members byclicking here and non-members may purchase the report through the GBTA Foundation by emailing pyachnes@gbtafoundation.org.

About the GBTA BTI™ Outlook – United States

The GBTA BTI™ Outlook – United States projects aggregate business travel trends over the next eight quarters. The report includes key buy-side metrics such as total business travel volume and spending, plus supply-side projections of changes in costs, across both transient and meetings travel. Releases are published on the second Tuesday of each quarter.

The GBTA BTI™ Outlook uses an econometric model created by Rockport Analytics to better inform the forecast process. The model explicitly relates measures of business trip volume and spending, sourced from D.K. Shifflet & Associates to key economic and market drivers of business travel including: U.S. Gross Domestic Product (GDP) and its components, U.S. Corporate Profits and Cash Flow, U.S. Employment & Unemployment, ISM Business Sentiment Index, Key Travel Components of CPI (airfare, lodging, food away from home, rental cars, fuel, transportation), among other components.

About the GBTA Foundation

The GBTA Foundation is the education and research foundation of the Global Business Travel Association (GBTA), the world’s premier business travel and meetings trade organization headquartered in the Washington, D.C. area with operations on six continents. Collectively, GBTA’s 7,000-plus members manage more than $345 billion of global business travel and meetings expenditures annually. GBTA provides its growing network of more than 28,000 travel professionals and 125,000 active contacts with world-class education, events, research, advocacy and media. The Foundation was established in 1997 to support GBTA’s members and the industry as a whole. As the leading education and research foundation in the business travel industry, the GBTA Foundation seeks to fund initiatives to advance the business travel profession. The GBTA Foundation is a 501(c)(3) nonprofit organization. For more information, see gbta.organd gbta.org/foundation.

CONTACT: Colleen Lerro, 703-236-1133, clerro@gbta.org

Gayle Kansagor, 202-295-8775, gayle.kansagor@harbourgrp.com

About the Global Business Travel Association

The Global Business Travel Association (GBTA) is the world’s premier business travel and meetings organization headquartered in Washington, D.C. area with operations on six continents. GBTA’s 7,000-plus members manage more than $345 billion of global business travel and meetings expenditures annually. GBTA and the GBTA Foundation deliver world-class education, events, research, advocacy and media to a growing global network of more than 28,000 travel professionals and 125,000 active contacts. To learn how business travel drives business growth, visit gbta.org